The Big Disconnect — The World Through the Rosy Lens of the S&P 500 Index

The Big Disconnect — The World Through the Rosy Lens of the S&P 500 Index

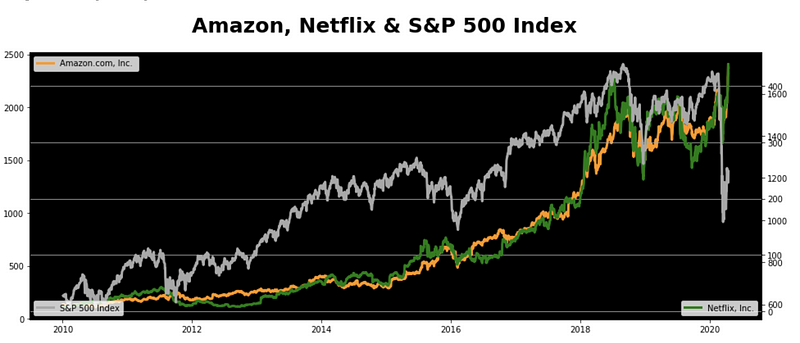

I’m no economist or epidemiologist but something doesn’t add up here. If, on Friday 17th, 2020, your only outlet to the world was the S&P500, what would you think? Just another normal day in our decade-old bull run, just 15% off its record peak two months ago? The height of the index was around $3,386, and this Friday, we closed at $2,874.

Holed up inside my apartment for over 30 days, I am one of those using the financial indexes as an outlet to the world. While essential workers are out keeping the lights on and medical workers are shielding us from harsh realities, all bravely risking their lives, the S&P 500 doesn’t seem to notice. The good news is, no matter how vulnerable our species is to this virus or how ill-equipped we are at handling pandemics (Bodies Rotting in the Street: COVID-19 Chaos Grips Ecuador), our digital worlds are healthier than ever!

The New Normal

Is it because most of us are reduced to ordering life necessities through Amazon (AMZN) and watching Netflix (NFLX) while waiting for the doorbell to ring?

Here they are, the starts of 2020, I even added the S&P 500 Index for good measure. Seeing the prices of those stocks makes me think that my new way of life is the same for many others.

Are things propped up by the brutal and unabated waves of layoffs (The coronavirus outbreak has triggered unprecedented mass layoffs and furloughs)? It’s ironic that we label them as “furloughs”. Every little task that has ingenuously been automated during this pandemic will stay that way… forever. Or are they propped up by the massive financial interventions, corporate handouts, and big promises of rent and mortgage suspensions (Coronavirus: Italy to suspend mortgage payments amid outbreak)?

Once they open our cages and let us out… brace yourself for a dosage of reality hitting us smack in the face! The handful of big tech companies won’t be able to prop this index any longer.

What’s a More Realistic Measure of the Economy?

We’re clearly riding the tailwinds of a few tech monster companies that have kept the majority of us functional and somewhat sane… I know a few that bragged about buying the lows in March — good for them — but, once the cold waters of reality wake us up, will they be the suckers that caught a falling knife?

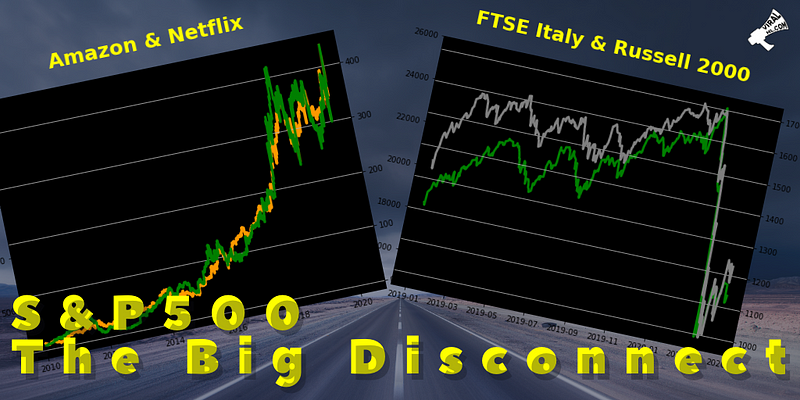

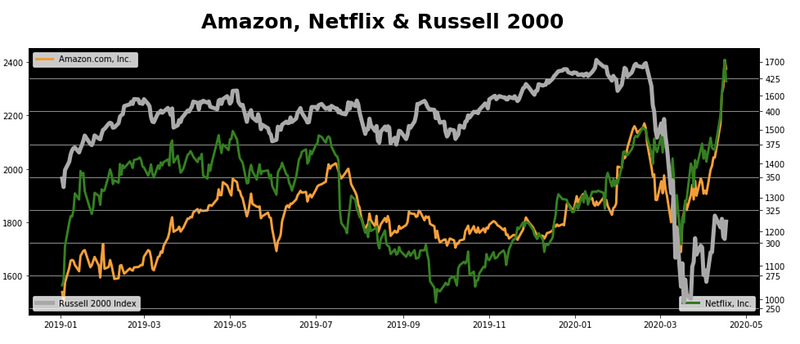

If we juxtapose those two high-flying stocks against the Russell 2000 Index, which represents the smallest mid-cap companies contained within the Russell 3000 Index, we see a different picture.

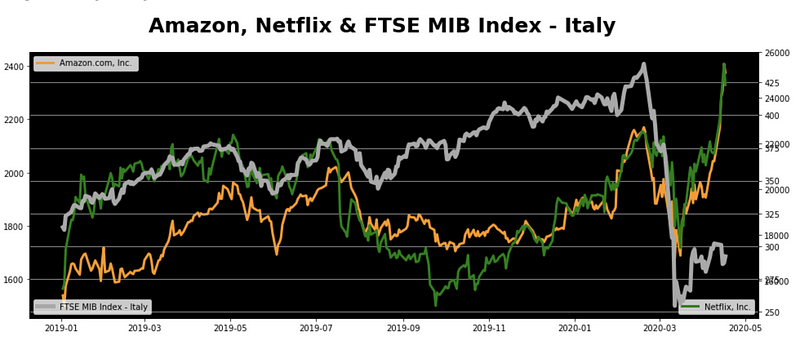

Another way to bring this home is to compare our two favorite companies with the FTSE MIB Index, the Italian Stock Exchange in Milan — Borsa Italiana.

Notice anything weird? Yes, the Russell and the Italian Bourse look like twins.

So many reports talked about how looking at Italy is like peeking in our future, they weren’t kidding — this is as much about the virus as it is about the economy.

Good luck to us all!